September 14, 2023

Climate Change Effects on Real Estate

Regulatory Changes

Municipalities and governments are implementing stricter building codes and zoning regulations in response to climate change. These changes may require property owners to make costly upgrades to adapt to new standards or restrict certain types of development in high-risk areas.

Increased Insurance Costs

As climate-related events become more frequent and severe, insurance premiums for properties in high-risk areas are likely to rise. This can add to the overall cost of property ownership and impact affordability.

Infrastructure Challenges

Areas prone to flooding and other climate-related issues may require significant infrastructure investments to mitigate risks. Property owners may face higher taxes or assessments to fund these projects.

Erosion and Coastal Property Loss

Rising sea levels and coastal erosion threaten properties along coastlines. In some cases, property loss due to erosion can result in legal disputes and financial losses for property owners.

Financing Challenges

Lenders and insurers may become more cautious about financing properties in climate-vulnerable regions. They may require more stringent risk assessments, higher down payments, or even refuse to provide loans for properties in high-risk areas.

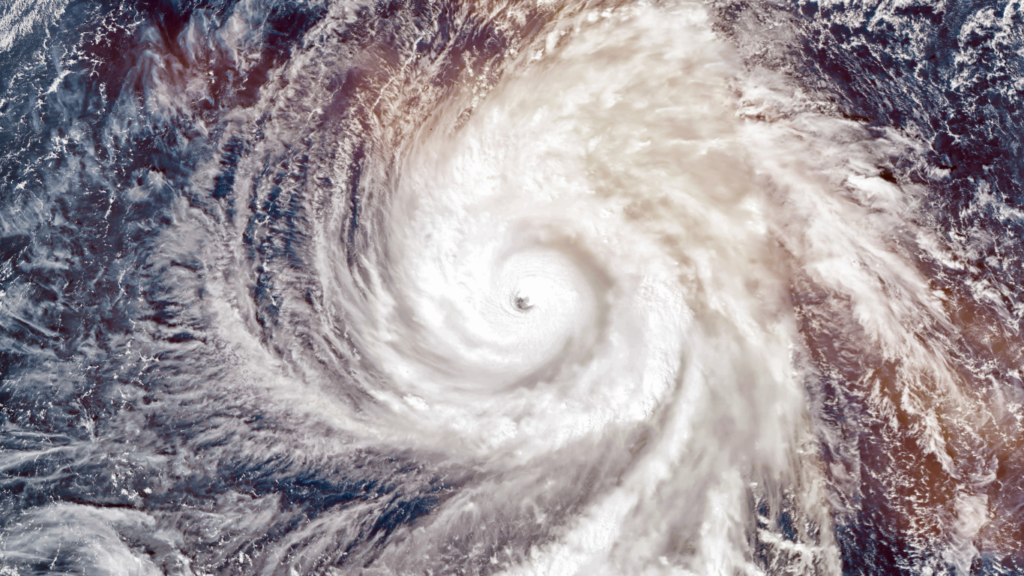

Property Value Risk

Properties located in areas vulnerable to climate-related hazards, such as flooding, hurricanes, wildfires, and sea-level rise, may experience declining property values. This can lead to decreased returns on investment and potential financial losses for property owners.

Energy Efficiency and Sustainability

As concerns about climate change grow, there is a greater demand for energy-efficient and sustainable properties. Buildings with high energy efficiency ratings and green certifications may command higher prices and rental rates.

Market Perception

Buyers and investors are increasingly factoring climate risk into their decisions. Properties in climate-resilient locations may become more attractive, while those in vulnerable areas may become less desirable, leading to shifts in market demand.

Opportunities for Innovation

The real estate industry has an opportunity to innovate and invest in climate-resilient building designs, renewable energy integration, and sustainable infrastructure, which can create new market niches and potentially increase property values.

The impact of elevated temperatures on property owners encompasses several aspects, including escalated expenditures on cooling-related energy consumption, the potential for structural deterioration involving roofs and foundations, as well as a depreciation of property values arising from apprehensions associated with climate-related factors.

In summary, climate change poses both challenges and opportunities for the real estate industry. Property owners, developers, and investors need to assess climate risk, adapt to changing regulations, and incorporate sustainability measures into their strategies to navigate the evolving landscape of the real estate market in a changing climate.

At Faith Filled Investments, we possess an extensive network of resources tailored to address a diverse range of real estate challenges. We invite you to get in touch with us to gain privileged access to our roster of experienced business professionals, each specializing in specific areas of expertise, adeptly equipped to assist you with your unique requirements. Click on the link to contact us. https://faithfilledinvestments.com/contact-us/

Presented by David Bolden