November 24, 2022

IS IT A BAD TIME TO INVEST IN REAL ESTATE?

There’s a strong demand for long-term rental properties and vacation rentals throughout the U.S. despite the rising interest rates. Property prices are lowering, and sales are declining making it easier for capitalized property owners to buy rentals.

Unemployment is low and wages are still on the rise, causing more qualified renters to fuel the market. As stock prices decrease, it will cause more and more investors to seek returns elsewhere.

Focus on cash flow, appreciation, loan terms, leverage and tax benefits to gain the most for choosing a rental property. I have learned that betting purely on appreciation is one of the biggest mistakes an investor can make when purchasing a property.

The property type plays a huge role in determining the answer to this question.

- Retail – Retail properties are still battling with the online giants that are shipping products straight from the warehouse to the consumer.

- Industrial – Warehouses are holding strong due to the low supply of land availability to support the demand that many developers are seeking to get the best price per acreage.

- Office – Office Spaces are still taking hits from the pandemic, making it tougher for landlords to maintain the same tenants, forcing many to think outside the box on leasing out vacant space to create cashflow.

- Multifamily – Based on current market data, competition amongst those who are looking to rent properties in multifamily are still bidding against others, due to the shortage of inventory.

Three Tips to Purchasing

- When purchasing a property, purchase when the market is right for you, not based on others competence or financial statements.

- Second, make sure it is a good investment. Don’t fall in love with a property or location and try to make numbers work when they really don’t work.

- Third, contact a specialist to add value in areas that are not your expertise.

Why Multifamily Properties a Great Asset Class

The multifamily industry is currently benefitting from an imbalance in supply and demand, which is generating higher income and cash flows not available with other asset classes. Most renters are priced out of homeownership by inflated home costs and rising interest rates, resulting in more people joining the rental market.

Supply and Demand is a Key Indicator

Demand for rental housing still far exceeds current supply short of 600,000 units, as reported by the National Multifamily Housing Council and the National Apartment Association. Inflation makes it quite challenging for investors to receive their preferred Rate of Return (ROI) halting the need for more affordable multifamily housing. As homes become more expensive to buy, and new product more expensive to build, the existing inventory of rental housing becomes more valuable and in-demand.

Inflation

Historically, apartment rents have tended to outpace overall inflation rates. However, it has become more difficult property owners to push rents upward, based on the markets. One of the top benefits of Multifamily properties having the ability to serve as a hedge against inflation is by having the opportunity to reset lease rates as frequently as every 12 months and using monthly leases in lower Class properties, compared to three to 10 years for other property types. This provides property managers with the flexibility to quickly reset pricing to meet demand or offset rising operational costs.

Tax Benefits

Some investors strategy is to buy and hold, with plans to never sell. A benefit from doing so is though depreciating the property (particularly with bonus depreciation through cost segregation). For those who are interested in a short hold period (around 5 years or longer), it is a great idea to consult with a tax specialist who focus on executing a 1031 Exchange. This strategy allows investors to defer the federal and state income tax that would normally be due for selling a property that has appreciated if the investor uses the sale proceeds to immediately purchase another “like-kind” property.

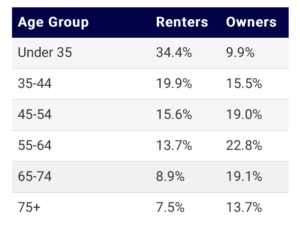

Demographic Trends

More than half of the United States’ population are members of the millennial generation. The prime age group for renters are between 20-35 years old and continuing to increase in size. Many millennials continue to rent, whether as a lifestyle choice or due to rising home prices and higher student loan debt. Gen Z has now entered the rental housing market, which will have a significant impact in the years ahead. Baby boomers also continue to be a significant source of apartment demand based on inflation, causing many to seek downsizing for their golden years.

Valuations

There are many investors concerned about the valuations of properties. Cap rates are currently on the rise (decreasing property values for many markets), as interest rates have caused many funds and private equity groups to sit on the sidelines. However, individuals who are well capitalized and large institutional companies have a tremendous amount of equity that needs to be deployed for apartments and many are expecting transactional volume will pick back up by the mid part of 2023, with hopes that capital returns to the market, stabilizing cap rates.

Conclusion

Is this the right time to incorporate a rental property into your investment portfolio? This question sparks significant debate. Drawing from my experience and market analysis, there isn’t a universally wrong time to acquire real estate, whether it be an apartment, house, or land. The crucial factor lies in the specific market you’re entering, as it dictates the demand for rental properties in your vicinity. It’s advisable to adopt a long-term perspective and examine locations that pass the analysis test of job opportunities and population growth.

In the words of Mark Twain, “Buy land, they aren’t making any more of it.” This saying underscores the enduring value of land. Similarly, investing in apartments remains a prudent choice, given that people continue to expand their families, creating a sustained demand for housing.